Discover the benefits of the Axis Altas Credit Card! Enjoy rewards, airport lounge access, no annual fee for the first year, and more. Apply today!

Table of Contents

Introduction

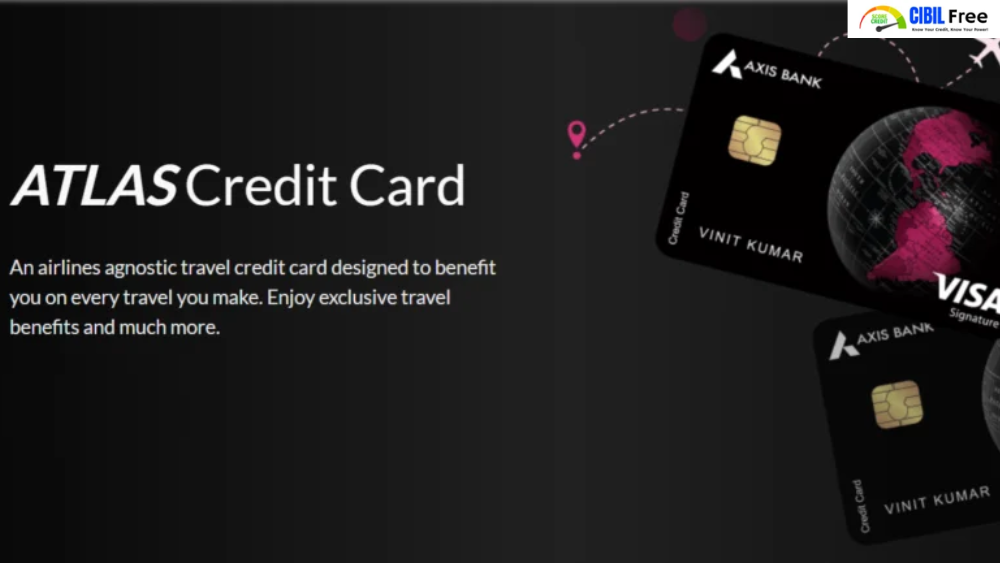

If you’re in the market for a premium credit card that offers more than just a way to pay for your purchases, the Axis Altas Credit Card could be your perfect match. Packed with rewards, exclusive offers, and top-tier benefits, this card is designed for individuals who want more from their financial tools. In this guide, we’ll dive into everything you need to know about the Axis Altas Credit Card – from its perks to how to apply. Ready to learn more? Let’s go!

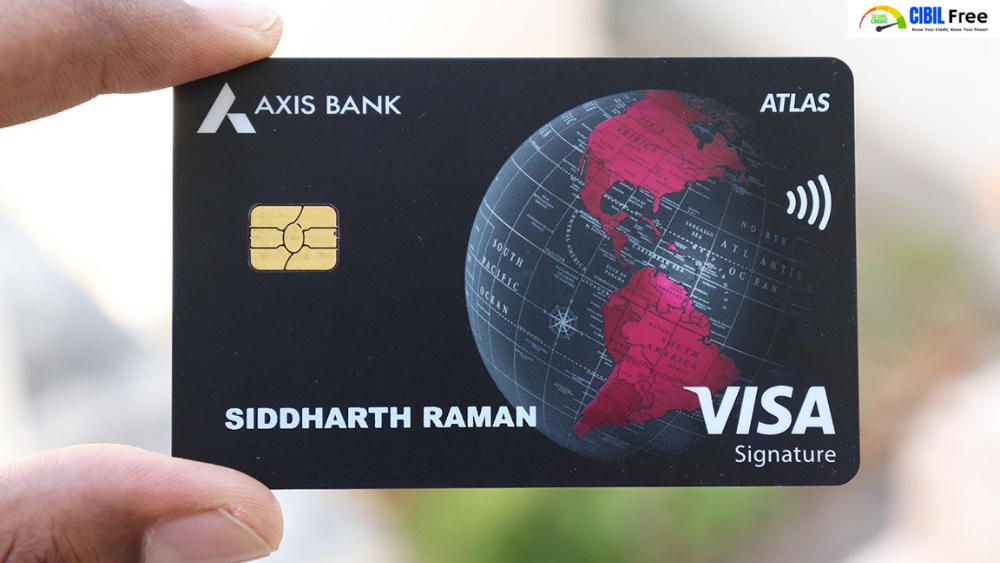

What is the Axis Altas Credit Card?

The Axis Altas Credit Card is one of the top premium credit cards offered by Axis Bank, packed with perks designed to give you more bang for your buck. Whether you’re a frequent traveler, an online shopper, or someone who just enjoys the finer things in life, this card has a ton to offer. From an impressive rewards program to airport lounge access, the Axis Altas CreditCard is built to make your financial experience more rewarding.

But what exactly makes it stand out? Let’s break it down.

Key Features of the Axis Altas Credit Card

1. Rewards Program

This is where the Axis Altas CreditCard truly shines. You earn reward points for every transaction you make – whether it’s buying groceries, booking travel, or shopping online. These points add up quickly, and the best part? You can redeem them for a wide range of goodies like flight bookings, hotel stays, shopping vouchers, and even cashback. So the more you spend, the more you get in return!

2. Zero Annual Fee for the First Year

Who doesn’t love a good deal? The Axis Altas CreditCard offers a zero annual fee for the first year. This is great if you’re hesitant to commit upfront. You get to enjoy all the premium benefits of the card with no annual charge for the first 12 months. After that, the fee is pretty reasonable considering the value you’re getting.

3. Special Offers and Discounts

As a cardholder, you’ll be treated to exclusive offers and discounts. These can range from discounts on travel bookings to dining offers and shopping deals. It’s like having a personal concierge at your fingertips, ready to save you money wherever you go.

How Does the Rewards Program Work?

The rewards program is straightforward, and here’s how you can make the most of it:

Earn Points on Every Transaction

The beauty of the Axis Altas CreditCard is that it lets you earn points on every purchase. Whether you’re grabbing coffee at your local café or booking a flight to Paris, each transaction puts points back into your account. Over time, these points can add up to some serious savings.

Redeem Points for Travel, Shopping, and More

You’re not stuck with just one way to redeem your points. Whether you want to book a flight, enjoy a shopping spree, or even grab some cashback, your points are flexible. The more you use the card, the more rewards you get to enjoy.

Benefits of the Axis Altas Credit Card

1. Airport Lounge Access

For those who travel frequently, airport lounges are a game-changer. The Axis Altas Credit Card gives you complimentary access to select lounges worldwide. This perk allows you to relax before your flight with amenities like free Wi-Fi, refreshments, and a peaceful environment. Forget the crowded terminal – unwind in style!

2. Fuel Surcharge Waiver

Driving a lot? The Axis Altas CreditCard waives the fuel surcharge at select petrol stations. This can add up over time, especially if you’re commuting regularly. It’s a small but valuable benefit for everyday drivers.

3. Global Acceptance

The Axis Altas CreditCard is accepted globally, meaning whether you’re shopping in the U.S. or dining in Japan, you won’t have to worry about finding a payment method. This makes it incredibly convenient for international travelers.

4. Security Features

When it comes to your security, the Axis Altas CreditCard is top-notch. It comes equipped with contactless payment technology, allowing you to pay quickly and safely. Plus, you’ll get fraud protection alerts for any suspicious activity, so you’re always in control of your finances.

How to Apply for the Axis Altas Credit Card

So, you’re ready to get your hands on this awesome card? Here’s how to apply:

Eligibility Criteria

Before applying, make sure you meet the eligibility criteria. You’ll need to be over 21 years old, have a stable income, and maintain a good credit score. You can find the full list of requirements on the Axis Bank website, but these are the basics to keep in mind.

Step-by-Step Application Process

The application process is easy and straightforward. Here’s a quick rundown:

- Visit the Axis Bank website and fill out the online application form.

- Submit required documents, including proof of identity, address, and income.

- Wait for your application to be processed and approved.

- If approved, your Axis Altas Credit Card will be mailed to you.

Once you’ve got your card, you’re all set to start earning those rewards!

Axis Altas Credit Card vs Other Credit Cards

How does the Axis Altas Credit Card compare to others in the premium card category? When you stack it up against other cards, the Axis Altas stands out because of its combination of rewards, no-fee first year, and exclusive benefits like airport lounge access. Plus, the reasonable annual fee after the first year ensures that it remains accessible compared to other premium credit cards.

Fees and Charges

While the Axis Altas Credit Card offers tons of benefits, like all credit cards, it does come with some fees. Here’s a quick breakdown:

- Annual Fee: Waived for the first year; charged after that.

- Foreign Currency Transaction Fee: If you’re using your card abroad, there’s a small fee for currency conversion.

These fees are competitive, especially considering the card’s premium benefits.

How to Maximize Benefits of the Axis Altas Credit Card

Want to make sure you’re getting the most out of your Axis Altas Credit Card? Here are some tips:

- Use it for all your purchases – groceries, dining, travel – so you rack up those reward points.

- Stay on top of special offers – Axis Bank often runs promotions where you can earn extra points or enjoy bigger discounts.

- Pay your bills on time – this helps you maintain a healthy credit score and avoid late fees.

The more you use your card wisely, the more value you’ll get in return!

Customer Support and Service

Need help? Axis Bank has 24/7 customer support, so you can always reach out if you have any questions or issues with your card. Whether it’s about your rewards, a lost card, or a billing question, Axis Bank’s team is ready to assist.

Conclusion

The Axis Altas Credit Card is more than just a tool for making purchases – it’s a gateway to a world of benefits, rewards, and luxury perks. Whether you’re looking to earn rewards on everyday spending or enjoy exclusive travel benefits, this card delivers. With a zero annual fee for the first year, you get a risk-free introduction to its many advantages. So, if you’re ready to step up your credit card game, the Axis Altas Credit Card might be the perfect fit for you!

BOB Credit Card Benefits, Applying, Fees & Charges

FAQs About Axis Altas Credit Card:

What is the Axis Altas Credit Card?

The Axis Altas Credit Card is a premium credit card offering rewards, airport lounge access, and exclusive discounts on travel, shopping, and more.

Is there an annual fee for the Axis Altas Credit Card?

No, there is no annual fee for the first year. After that, a nominal fee is charged for the following years.

How do I apply for the Axis Altas Credit Card?

You can apply online through Axis Bank’s website or by visiting an Axis Bank branch.

What are the eligibility requirements for the Axis Altas Credit Card?

You need to be over 21 years old, have a stable income, and a good credit score to apply.

How do I earn reward points with the Axis Altas Credit Card?

You earn reward points on every purchase made using your Axis Altas Credit Card, from groceries to travel bookings.

What can I redeem my reward points for?

You can redeem your points for travel bookings, shopping vouchers, hotel stays, and even cashback.

Does the Axis Altas Credit Card offer airport lounge access?

Yes, cardholders enjoy complimentary access to select airport lounges worldwide.

Is the Axis Altas Credit Card accepted internationally?

Yes, the card is accepted globally, making it perfect for international travel.

How can I check my reward points balance?

You can check your points balance through the Axis Bank mobile app or by logging into your account on their website.

Are there any foreign transaction fees with the Axis Altas Credit Card?

Yes, a foreign currency transaction fee applies when you make purchases in foreign currencies.

What security features does the Axis Altas Credit Card offer?

The card offers contactless payments, fraud protection, and instant alerts for suspicious activities to keep your finances secure.

Can I get a fuel surcharge waiver with the Axis Altas Credit Card?

Yes, the card offers a fuel surcharge waiver at select fuel stations, saving you money on your regular fueling trips.

How do I contact customer support for the Axis Altas Credit Card?

You can contact Axis Bank’s 24/7 customer support via phone, email, or through the bank’s official website for any assistance.

What are the additional benefits of the Axis Altas Credit Card?

Other benefits include exclusive offers, discounts on dining, shopping, and special promotions tailored for cardholders.

How can I maximize the rewards with the Axis Altas Credit Card?

Use your card for everyday purchases, stay informed about special offers, and always pay on time to get the most rewards.

By: Cibilfree.Com

Pingback: Indusind Tiger Credit Card Eligibility Criteria & Charges