Explore the fees and SBM Magnet Credit Card Charges, including late payment fees, cash withdrawal charges, forex markup, and more for informed usage.

Table of Contents

Introduction

While the SBM Magnet Credit Card offers a wealth of benefits, including no annual fee and impressive rewards, it’s essential to understand the associated fees and charges to avoid any surprises. Below, we break down all the key fees you should be aware of when using your card.

Joining/Annual Fee: NIL

One of the most attractive features of the SBM Magnet Credit Card is that it comes with no joining or annual fees. This makes it an excellent choice for cardholders who want to enjoy a credit card with minimal costs and maximize the rewards they can earn without the burden of yearly fees.

Late Payment Fee: Rs 299

If you miss a payment due date, the SBM Magnet Credit Card imposes a late payment fee of Rs 299. It’s important to stay on top of your payments to avoid these charges, as late payments can also impact your credit score.

Penalty on Premature FD Withdrawal: 1%

The credit card is secured by an SBM Bank Fixed Deposit (FD), and if you choose to withdraw your FD prematurely, you will incur a penalty fee of 1% of the amount withdrawn. This penalty is in place to protect the bank’s lending terms and ensure stability for the cardholder’s credit.

Card Cancellation Fee: Rs 499

Should you decide to cancel your SBM Magnet Credit Card, there is a cancellation fee of Rs 499. It’s important to weigh this cost before making the decision to cancel, as this charge will be deducted from your account.

Card Replacement Fee: Rs 249

In case your card is lost or damaged, a replacement fee of Rs 249 will be charged for issuing a new card. This fee is relatively low compared to many other credit cards, but it’s important to handle your card with care to avoid unnecessary charges.

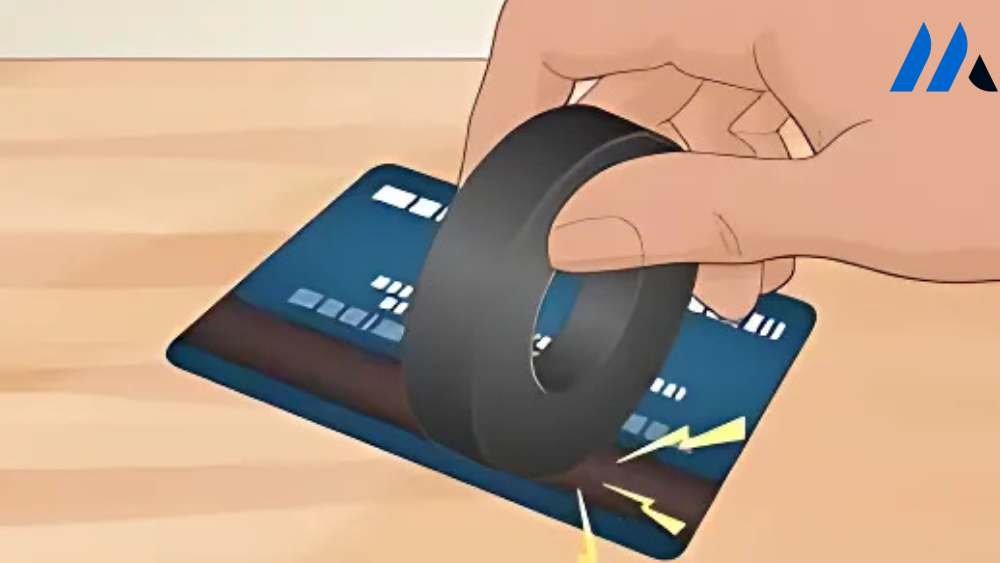

Cash Withdrawal Fees/ATM Withdrawal Fees: 2.5% or Rs 300

Withdrawing cash from your SBM Magnet Credit Card comes at a high cost. The cash withdrawal fee is 2.5% of the withdrawal amount or Rs 300, whichever is higher. Cash advances come with additional interest charges and fees, so it’s best to use this feature sparingly.

Rewards Redemption Fee: NIL

Good news for cardholders! There is no fee for redeeming your reward points. This makes it easy and cost-effective to enjoy the perks of your rewards, whether it’s shopping vouchers, travel discounts, or other benefits available through the SBM Magnet Credit Card rewards program.

Surcharge Fee: 1%

When making payments for utility bills or specific types of transactions, you may incur a surcharge fee of 1%. This charge is typically added to the transaction amount, and it’s important to keep an eye on the total payment amount.

Forex Markup Fee: 2.49%

If you use your SBM Magnet Credit Card for international transactions, there is a foreign exchange markup fee of 2.49%. This fee is applied to any transaction made in a foreign currency, so it’s important to consider when making international purchases with your card.

Conclusion

While the SBM Magnet Credit Card offers a variety of rewarding features, understanding the fees and charges associated with the card is crucial for managing your finances effectively. With no joining/annual fees, nil rewards redemption fee, and reasonable charges for services like card replacement or late payment, the card provides good value. However, high fees for cash withdrawals and forex markups can add up, so it’s important to use these features cautiously.

By being aware of these costs and planning your card usage carefully, you can make the most of the SBM Magnet Credit Card‘s rewards and benefits while minimizing unnecessary charges.

Magnet Credit Card Rewards: Welcome Benefits & Points

FAQs About SBM Magnet Credit Card Charges:

What is the joining fee for the SBM Magnet Credit Card?

The SBM Magnet Credit Card has no joining or annual fees, making it cost-effective for cardholders.

Is there a fee for late payment?

Yes, if you miss the payment due date, the late payment fee is Rs 299.

What happens if I withdraw money using my SBM Magnet Credit Card?

For cash withdrawals, the fee is 2.5% of the withdrawal amount or Rs 300, whichever is higher.

What is the penalty for prematurely withdrawing my fixed deposit?

If you withdraw your fixed deposit early, you will incur a penalty fee of 1% on the withdrawn amount.

How much do I have to pay for card replacement?

If your card is lost or damaged and you need a replacement, the fee is Rs 249.

Is there a fee for canceling my SBM Magnet Credit Card?

Yes, there is a card cancellation fee of Rs 499 if you decide to cancel the card.

Are there any fees for redeeming rewards points?

No, there is no fee for redeeming your reward points on the SBM Magnet Credit Card.

What is the surcharge fee on the SBM Magnet Credit Card?

A surcharge fee of 1% is applied to certain transactions, such as utility bill payments.

What is the forex markup fee on international transactions?

For international transactions, a forex markup fee of 2.49% is applied to the purchase amount.

Are there any hidden charges for using the SBM Magnet Credit Card?

No, the SBM Magnet Credit Card has no hidden charges. The fees are clearly stated, including late payment fees, cash withdrawal charges, and others.

Is there an interest rate on cash advances?

Yes, the interest rate on cash advances is typically higher than standard purchases, and it is applied from the date of withdrawal.

Are there any fees for ATM withdrawals outside of India?

Yes, if you withdraw cash from an ATM outside India, foreign transaction fees and the standard cash withdrawal fees may apply.

Can I use my SBM Magnet Credit Card without incurring any fees?

To avoid fees, you should make payments on time, avoid cash advances, and stay within the credit limit. This way, you can enjoy the card’s benefits without incurring charges.

How do I avoid the cash withdrawal fee?

To avoid the cash withdrawal fee, refrain from using the credit card to withdraw cash from ATMs. Use your card for purchases instead.

Are there any fees for using the SBM Magnet Credit Card for online purchases?

There are no additional charges for online purchases, but regular charges such as the forex markup fee (for international transactions) may apply.

By: Cibilfree

Pingback: SBM Magnet Credit Card Interest Rates & How To Manage