SBI Aurum Credit Card — an exclusive, invite-only premium card by State Bank of India, designed for high net-worth individuals. Enjoy luxurious benefits like unlimited airport lounge access, high reward points, concierge services, complimentary memberships, and elite lifestyle privileges. With a stylish design and premium welcome kit, the Aurum card is more than just a payment tool — it’s a status symbol. Learn about fees, features, eligibility, and how it compares to other premium cards like HDFC Infinia and Axis Magnus. Explore whether the SBI Aurum is the right luxury card for your lifestyle.

Table of Contents

Introduction: SBI Aurum Credit Card

Looking for a credit card that screams luxury, perks, and sheer exclusivity? Enter the SBI Aurum Credit Card—State Bank of India’s most premium offering that’s tailored for India’s elite. But does it really justify its “luxury” tag? Or is it just another shiny card with a high annual fee? Let’s dig into everything you need to know, from its flashy benefits to the hidden fine print.

What is the SBI Aurum Credit Card?

Think of the SBI Aurum as the royal suite of credit cards. It’s an invite-only premium card designed for high net-worth individuals (HNIs) who crave perks beyond cashback and discounts. From travel privileges to luxury lifestyle experiences, the Aurum card is all about status and service.

Key Features of the SBI Aurum Credit Card

Premium Welcome Benefits

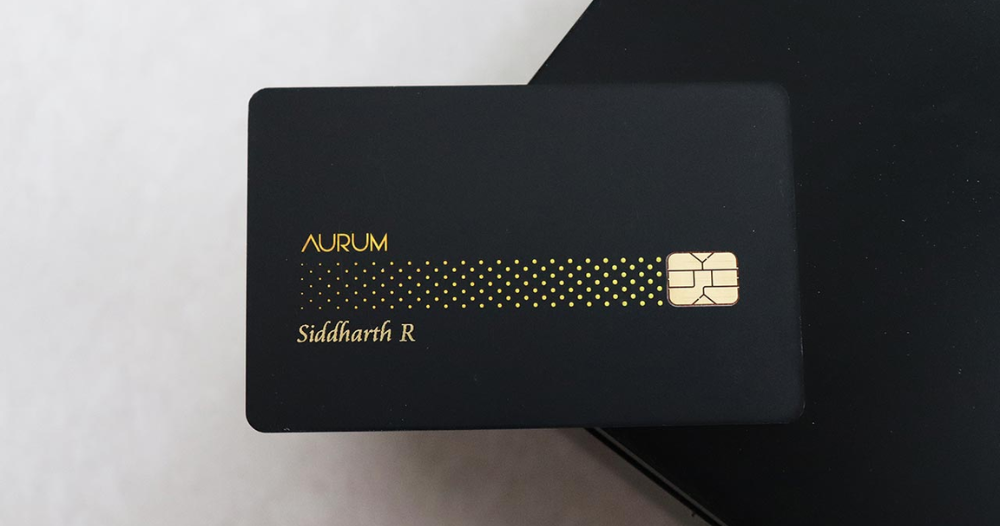

New cardholders are welcomed with a premium welcome kit worth ₹25,000, which includes luxury vouchers, fine-dining experiences, and a sleek, matte-black card design that oozes sophistication.

High Reward Points System

With the Aurum card, you earn 4 reward points per ₹100 spent, and bonus points on your birthday, travel, dining, and international transactions. That’s not pocket change—it’s serious reward power.

Exclusive Airport Lounge Access

Say goodbye to crowded airport terminals. With unlimited international and domestic lounge access, Aurum gives you a First-Class experience, even before you board your flight.

Complimentary Memberships

Get access to Zomato Pro, Club Marriott, and Times Prime, bundled with your card—no extra cost. Perfect for foodies and weekend staycation fans.

Concierge Services

Need a last-minute table at a five-star restaurant? Or a personalized gift delivered across the country? The 24×7 concierge team is like your personal assistant on speed dial.

Annual Fees and Charges

Membership Fees

The SBI Aurum Credit Card comes at a premium price—₹9,999 annual fee + taxes. But the welcome benefits and reward structure offer enough value to potentially offset this cost.

Interest Rates & Other Charges

The interest rate sits around 3.35% per month (40.2% annually). Also, there’s a foreign transaction fee of 1.99%, which is quite competitive for international travelers.

SBI Aurum Rewards Program Explained

How Reward Points Work

- Earn 4 points per ₹100 on regular spending

- Earn 20 points per ₹100 on birthday spends (yes, really!)

- Accelerated rewards on travel, dining, and international purchases

Redemption Options

Your reward points are as flexible as they come:

- Redeem via the Aurum Rewards Portal

- Book flights, hotels, or shop luxury items

- Transfer to partner loyalty programs

Travel Benefits

International Lounge Access

With Priority Pass, you get access to 1,000+ international lounges. Whether you’re jet-setting to Europe or the Middle East, your Aurum card has you covered.

Priority Pass Membership

You’re not just getting a pass—you’re getting unlimited complimentary access for yourself and a guest. Perfect for business travelers who are always on the go.

Dining and Lifestyle Privileges

Partner Restaurants

Enjoy curated fine-dining experiences with up to 25% off at partnered luxury restaurants across metro cities.

Luxury Brand Offers

From exclusive pre-launch invites to private shopping experiences at brands like Jimmy Choo and Montblanc, Aurum users live the high life.

Security and Safety Features

Contactless Payments

Your card comes with NFC-enabled technology, which means you can tap to pay without swiping or entering your PIN for small purchases.

Card Protection Plan

In case of loss or theft, SBI offers zero liability on fraudulent transactions reported within 48 hours. Peace of mind? Checked.

How to Apply for the SBI Aurum Credit Card

Eligibility Criteria

This card is invite-only, so you can’t apply directly. Typically, SBI invites:

- High-net-worth individuals (income > ₹25L/annually)

- Long-time SBI customers with strong credit history

Conclusion

The SBI Aurum Credit Card is a power-packed, lifestyle-first credit card that caters to those who want more than just cashback. It’s not about spending money—it’s about spending it right, with elegance, comfort, and benefits that make you feel valued. If you receive an invite and your lifestyle aligns with luxury travel, dining, and high-volume spending, this card could become your best financial companion.

HDFC Infinia Bharat RuPay Credit Card: The Ultimate Guide

FAQs

What is the SBI Aurum Credit Card?

The SBI Aurum Credit Card is a premium, invite-only credit card offered by State Bank of India for high-net-worth individuals, featuring luxury lifestyle perks, high rewards, and exclusive access.

Who is eligible for the SBI Aurum Credit Card?

Eligibility is by invitation only. Generally, it’s offered to individuals with high annual income (usually ₹25 lakhs or more), excellent credit scores, and a premium banking relationship with SBI.

How can I apply for the SBI Aurum Credit Card?

You can’t apply directly. If you’re eligible, SBI will send you a personalized invitation. Once invited, you can complete your application through the SBI Aurum website or via your relationship manager.

What is the annual fee for the SBI Aurum Credit Card?

The annual fee is ₹9,999 plus applicable taxes. However, this can be justified by the high-value welcome benefits and ongoing rewards.

What are the welcome benefits of the SBI Aurum Card?

Cardholders receive a premium welcome kit worth ₹25,000, which includes luxury brand vouchers, lifestyle memberships, and access to elite services.

How does the rewards program work with SBI Aurum?

You earn 4 reward points for every ₹100 spent, with accelerated points on birthday, travel, dining, and international spends. Points can be redeemed for travel, gifts, or vouchers.

Can I access airport lounges with the SBI Aurum Credit Card?

Yes, the card offers unlimited complimentary access to domestic and international lounges through Priority Pass and other partnerships.

Is the SBI Aurum Credit Card good for international travel?

Absolutely. It offers global lounge access, lower foreign currency mark-up fees (1.99%), and travel concierge services — perfect for frequent flyers.

Does the SBI Aurum Credit Card offer dining discounts?

Yes, cardholders enjoy up to 25% off at premium partner restaurants, plus exclusive experiences through collaborations with dining platforms like Zomato Pro and Club Marriott.

Are there any lifestyle memberships included with the SBI Aurum Card?

Yes, complimentary memberships include Zomato Pro, Club Marriott, and Times Prime, enhancing both dining and entertainment experiences.

Is there a fuel surcharge waiver on the SBI Aurum Credit Card?

Yes, a 1% fuel surcharge is waived on transactions between ₹500 and ₹4,000 across all petrol pumps in India.

How secure is the SBI Aurum Credit Card?

It includes features like contactless payments, zero-liability on lost card reporting, and advanced fraud monitoring for peace of mind.

What happens if I lose my SBI Aurum Credit Card?

Immediately report it to SBI’s 24×7 helpline. You’ll get zero liability on any fraudulent transactions reported within 48 hours of the loss.

How do I redeem SBI Aurum reward points?

Points can be redeemed through the SBI Aurum Rewards Portal for flights, hotels, merchandise, and vouchers. Redemption is easy and flexible.

How does the SBI Aurum compare to other premium cards like HDFC Infinia or Axis Magnus?

While all offer luxury perks, SBI Aurum stands out for its concierge services, lounge access, and bundled memberships. However, other cards may offer better milestone benefits or transfer partners depending on your lifestyle.