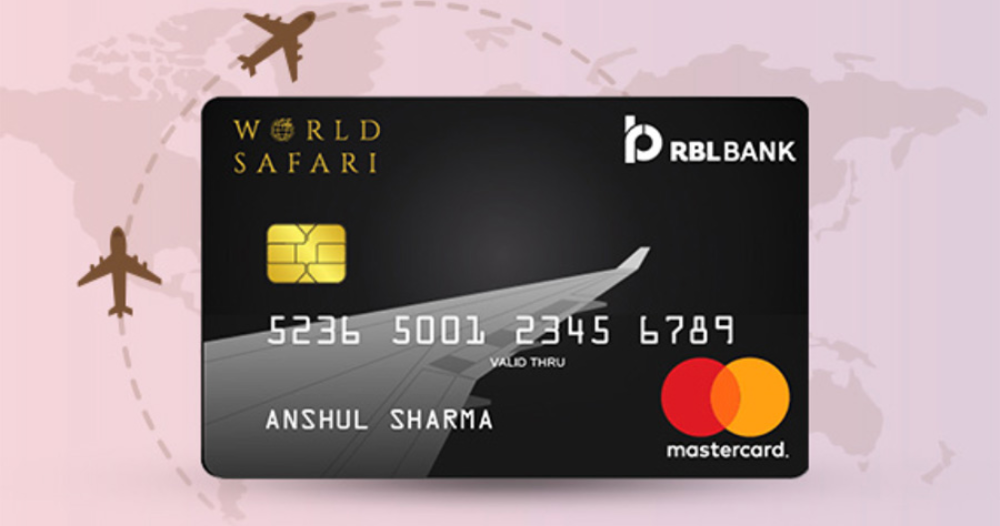

The RBL World Safari Credit Card offers unmatched benefits for frequent flyers and international shoppers. Enjoy 0% foreign currency markup, complimentary airport lounge access, welcome travel vouchers, and robust travel insurance coverage. Earn reward points on every international and travel-related spend, with flexible redemption options for flights, hotels, and more. Whether you’re a business traveler or a globetrotter, this card delivers premium perks at a reasonable annual fee.

Table of Contents

Introduction: Why a RBL World Safari Credit Card Matters

Let’s face it—traveling isn’t cheap. Between flights, hotels, food, and last-minute plans, your expenses can shoot up fast. That’s where a good travel credit card can swoop in like a superhero. It doesn’t just let you pay abroad hassle-free—it rewards you for doing so. And when it comes to travel-focused cards, the RBL World Safari Credit Card deserves a standing ovation.

Quick Overview

The RBL World Safari Credit Card is a premium travel credit card tailored for globetrotters who love collecting miles as much as memories. Packed with travel-specific perks, it’s got all the bells and whistles a frequent flyer could ask for.

Designed for the Avid Traveler

RBL didn’t just throw in a few travel perks and call it a day. This card is meticulously designed for those who are constantly on the move—especially internationally.

Zero Forex Markup: A Game Changer

Here’s the clincher: 0% foreign exchange markup. Yep, you read that right. Most cards charge you 2–3.5% every time you swipe internationally. But with this card? Nada. That alone can save you thousands if you travel often.

Complimentary Airport Lounge Access

Need to chill before a long-haul flight? You’re in luck. This card offers complimentary access to domestic and international lounges. You’ll feel like a VIP, even if you’re flying economy.

Welcome Benefits Worth Talking About

You’re welcomed aboard with goodies like MakeMyTrip vouchers, usually worth up to ₹3,000, just for joining. It’s like the card’s way of saying, “Bon voyage!”

Travel Insurance Coverage

Lost luggage? Flight delays? Medical emergencies abroad? The RBL World Safari Credit Card has your back with complimentary travel insurance, including personal accident cover and lost baggage support.

Reward Points on Travel Bookings

Get 2 reward points for every ₹100 spent on international transactions and travel bookings. That’s a pretty sweet deal if you’re always booking flights or hotels online.

Redemption Options and Flexibility

Flights and Hotel Stays

You can use those reward points to book flights or hotel stays directly through RBL’s partner platforms. It’s convenient and cost-saving—just how we like it.

Merchandise and Gift Vouchers

Not traveling soon? No problem. Redeem points for merchandise, gadgets, or even gift vouchers from top brands.

Joining Fee vs Renewal Fee

The joining fee is around ₹3,000 + GST, but RBL usually matches it with welcome vouchers of equal value. The renewal fee is also ₹3,000, but you can often get it waived by meeting annual spending thresholds.

Is It Worth the Cost? Let’s Do the Math

If you’re making regular international trips, the zero forex fee alone could save you more than ₹3,000 per year. Throw in lounge access and reward points? You’re definitely getting your money’s worth.

Who Can Apply?

To be eligible, you generally need to be:

- Between 21–65 years old

- Earning a stable monthly income

- A resident of India

What Do You Need to Submit?

- PAN Card

- Aadhaar Card or passport

- Salary slips or ITR returns

Conclusion : Should You Get the RBL World Safari Credit Card?

If you travel internationally, this card is a total no-brainer. With zero forex markup, great rewards, airport lounge access, and travel insurance, it checks all the right boxes. Sure, the fee is a bit on the higher side, but the value you get in return? Totally worth it.

IDFC FIRST Millennia Credit Card: A Complete Guide for Young Spenders

FAQs

What is the RBL World Safari Credit Card best known for?

The RBL World Safari Credit Card is best known for its 0% foreign exchange markup, making it ideal for international travelers and global shoppers.

Is there any welcome benefit when I apply for this card?

Yes, new cardholders receive MakeMyTrip vouchers worth up to ₹3,000 as a welcome gift, which effectively offsets the joining fee.

How does the reward points system work on this card?

You earn 2 reward points for every ₹100 spent on travel and international transactions. These points can be redeemed for travel bookings, vouchers, and merchandise.

Can I access airport lounges with this card?

Absolutely. The card offers complimentary airport lounge access to both domestic lounges and international lounges via Priority Pass.

Does the card come with travel insurance?

Yes, the RBL World Safari Credit Card provides complimentary travel insurance, including lost baggage cover, medical emergencies abroad, and trip delays.

What is the annual fee for the RBL World Safari Credit Card?

The annual fee is ₹3,000 + GST, which may be waived if you meet the card’s annual spending criteria.

Are there any charges for international transactions?

No, this card stands out by offering zero foreign currency markup, helping you save significantly on international transactions.

How can I redeem my reward points?

Reward points can be redeemed through RBL’s rewards platform for flights, hotel stays, gadgets, gift vouchers, and more.

Who is eligible for this credit card?

You must be an Indian resident aged 21 to 65 years, with a stable income and a decent credit score to apply.

How can I apply for the RBL World Safari Credit Card?

You can apply online through the RBL Bank website or offline by visiting a nearby RBL branch with the required documents.

Is there a fuel surcharge waiver with this card?

Yes, the card offers a fuel surcharge waiver at select fuel stations, subject to monthly caps and terms.

What documents are required for application?

You’ll typically need your PAN card, Aadhaar or passport, and income proof such as salary slips or ITR.

Does the card come with EMI options?

Yes, eligible purchases can be converted into EMIs via the RBL MyCard app, giving you more flexibility in managing payments.

Are the reward points valid forever?

No, reward points usually have a validity of 2 years from the date of accumulation, so it’s important to redeem them in time.

Can I use this card for domestic spending too?

Yes, you can, but the highest reward value is on international and travel-related transactions. For domestic spending, rewards are comparatively lower.