Your CIBIL score is like a report card for your financial health. Whether you’re planning to get a home loan, a car loan, or even a credit card, this little three-digit number plays a huge role. But what if your score isn’t where you’d like it to be? Don’t worry—you can boost it! And yes, you can do it online with a little help from Bajaj Finance. This guide walks you through the process step by step.

What is a CIBIL Score?

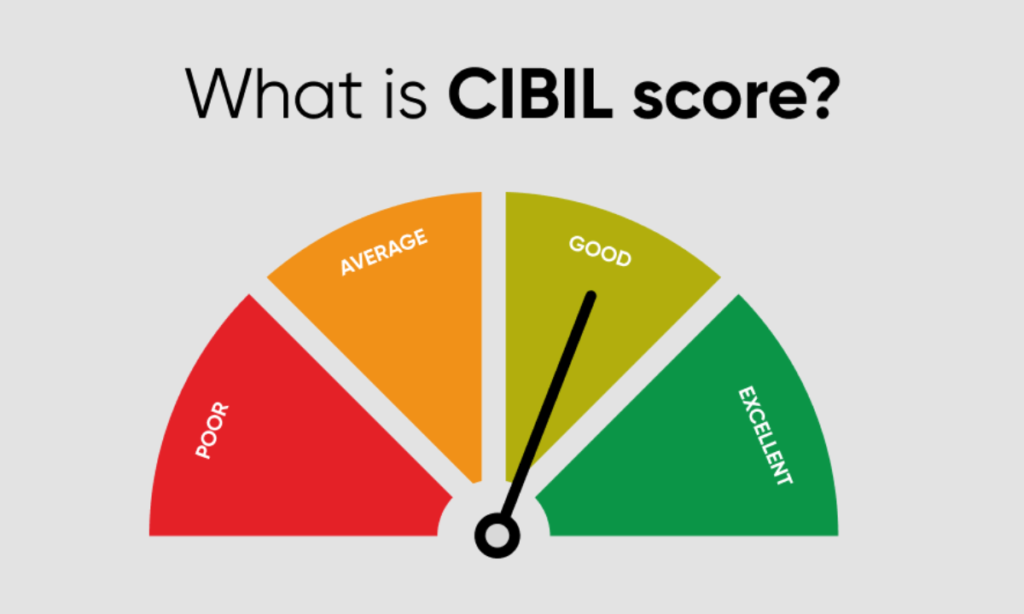

A CIBIL score is a credit score ranging from 300 to 900, and it reflects your creditworthiness. A score above 750 is considered excellent, opening doors to better financial opportunities. Your score is calculated based on your credit behavior, such as timely repayments, credit utilization, and the type of credit you’ve availed.

Why Your CIBIL Score Matters

A strong CIBIL score isn’t just a number—it’s a gateway to financial freedom. Let’s see how it benefits you:

Better Loan Eligibility

Banks and financial institutions rely on your score to determine if you’re a reliable borrower. A higher score increases the likelihood of loan approvals.

Lower Interest Rates

If your score is good, lenders see you as less risky. This means they’re willing to offer you loans at lower interest rates, saving you tons of money in the long run.

Factors That Impact Your CIBIL Score

Now that you know how important your score is, let’s dive into the key factors that influence it:

Payment History

Your history of repayments makes up about 35% of your score. Late payments? Big no-no. Timely payments? You’re golden.

Credit Utilization Ratio

This refers to how much credit you’re using compared to what’s available. Ideally, keep this ratio below 30% for a healthy score.

Credit Mix and Duration

Having a balanced mix of secured (e.g., home loans) and unsecured credit (e.g., credit cards) over a long period shows lenders you’re responsible.

Hard Inquiries

Every time you apply for a loan or credit card, lenders perform a hard inquiry. Too many of these can hurt your score.

Steps to Improve Your CIBIL Score

Let’s get to the practical stuff. These steps will put you on the fast track to a better score:

Pay EMIs and Credit Card Bills on Time

Late payments can seriously dent your score. Set reminders or automate payments to ensure you never miss a due date.

Reduce Credit Utilization

If you’re constantly maxing out your credit card, lenders might think you’re financially stressed. Keep your utilization low—below 30%, as mentioned earlier.

Monitor Your Credit Report

Errors happen, and they can drag your score down. Regularly review your credit report and dispute any inaccuracies.

Avoid Frequent Loan Applications

Applying for too many loans in a short span makes you look desperate to lenders, and that’s not a good look.

Maintain a Healthy Credit Mix

A mix of secured and unsecured loans shows you’re capable of handling different types of credit responsibly.

How Bajaj Finance Can Help Improve Your CIBIL Score Online

Bajaj Finance isn’t just about loans—it’s a full-fledged partner in improving your financial health. Here’s how they can help you fix your score online:

Pre-approved Loans

With Bajaj Finance, you get access to pre-approved loans that don’t require exhaustive credit checks. This minimizes hard inquiries and helps you stay on track.

Financial Wellness Programs

Bajaj Finance offers tools and workshops that educate you on how to manage credit and keep your score healthy.

Loan Repayment Assistance

Struggling with repayment? Bajaj Finance provides assistance to help you streamline your EMIs, ensuring you stay in good standing.

Free Credit Report Checks

Bajaj Finance lets you check your credit report online for free, helping you track your progress and spot errors easily.

FAQs About CIBIL Score Improvement

1. How long does it take to improve a CIBIL score?

It depends on your starting point. Minor improvements can take a few months, while bigger changes may require a year or more of consistent effort.

2. Can Bajaj Finance really help me improve my score?

Absolutely! With their financial tools, pre-approved loans, and credit education programs, Bajaj Finance is a reliable partner in boosting your score.

3. Is checking my credit report online free?

Yes! Many platforms, including Bajaj Finance, offer free credit report checks, and doing this won’t affect your score.

4. Can I improve my score if I’ve defaulted in the past?

Yes, but it’ll take time. Start by clearing outstanding dues and focusing on timely payments going forward.

5. Does having no credit history hurt my CIBIL score?

A lack of credit history doesn’t hurt your score but can make it harder for lenders to assess your creditworthiness. Consider starting with a small loan or credit card to build history.