In today’s world, your CIBIL score plays a crucial role in determining your financial credibility. Whether you are applying for a personal loan, home loan, or even a credit card, your CIBIL score significantly impacts your chances of approval. If you’re wondering, “CIBIL score online?” (How to increase CIBIL score online?), you’ve come to the right place! This guide will walk you through all the steps you can take to boost your CIBIL score, using online tools and easy-to-follow strategies.

Table of Contents

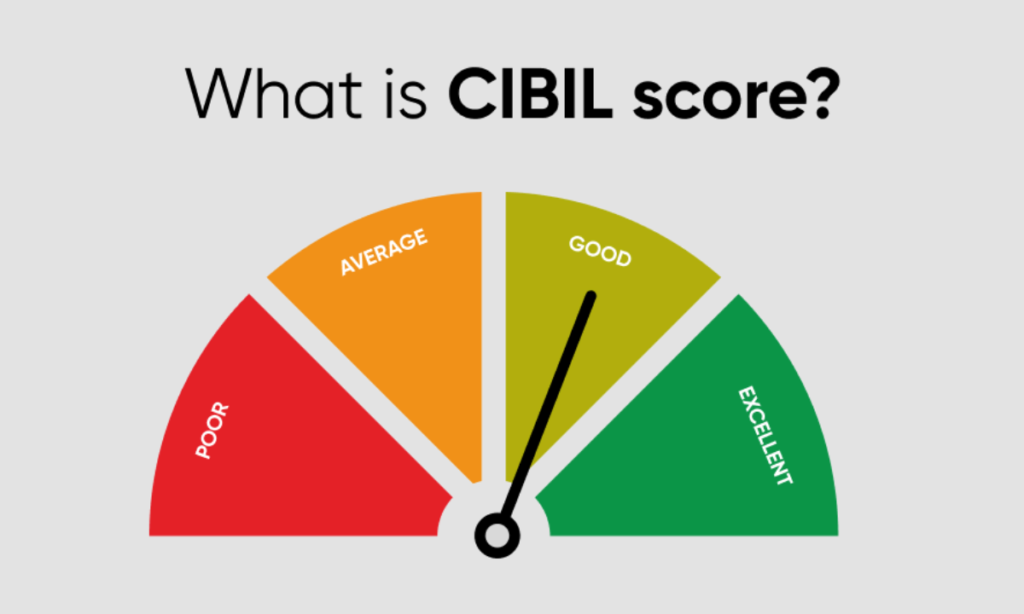

What is a CIBIL Score?

Before diving into how to improve your, let’s first understand what it is. A CIBIL score is a three-digit number ranging from 300 to 900, which represents your creditworthiness. The higher the score, the better your chances of getting approved for loans or credit cards. A score above 750 is considered excellent, while scores below 600 may raise red flags for lenders.

Understanding CIBIL Score in Detail

The CIBIL score is calculated based on the information in your credit report. This includes your credit history, how responsibly you have used credit, and whether you’ve made timely payments on loans and credit cards. A good CIBIL score indicates that you are likely to repay borrowed money, while a low score suggests the opposite. Lenders use this score to assess the risk of lending money to you.

Importance of a Good CIBIL Score

A higher CIBIL score is essential for securing loans with favorable terms. When your CIBIL score is high, you are more likely to qualify for loans at lower interest rates. This can save you a significant amount of money in the long run. Conversely, a low CIBIL score might mean that your loan applications get rejected, or you may only get approval with higher interest rates and stricter terms. In short, a good CIBIL score can open doors to better financial opportunities.

Why Improve Your CIBIL Score?

Improving your CIBIL score is essential for accessing better financial products. If you’re planning to purchase a home, car, or make any significant investment, a good CIBIL score is crucial. Not only does it improve your chances of getting loan approval, but it also ensures that you get the best possible interest rates. A better score means less financial stress and more control over your borrowing options.

Common Factors That Affect Your CIBIL Score

Several factors influence your CIBIL score. Here’s a look at the most common ones:

Payment History

Late payments or defaults on your loans and credit cards can severely lower your CIBIL score. If you have a history of missed or delayed payments, it will reflect negatively on your score.

Credit Utilization Ratio

This refers to how much of your available credit you are using. If you’re using more than 30% of your available credit, it can hurt your score. It’s always better to keep your credit utilization ratio low.

Credit Inquiries

Every time you apply for a loan or credit card, a hard inquiry is made on your credit report. Frequent applications for credit can lower your score, as it signals to lenders that you are in urgent need of credit.

Credit Mix

Having a variety of credit types, such as a mix of personal loans, credit cards, and home loans, can improve your score. A diverse credit portfolio indicates that you are capable of managing different forms of credit.

Credit Age

The length of your credit history matters. The longer you’ve been using credit responsibly, the higher your score will likely be. A long credit history reflects a stable financial behavior.

How to Improve Your CIBIL Score Online

Improving your CIBIL score online is easier than you think. With the right tools and strategies, you can raise your score over time. Follow these steps to start improving your score:

Step 1: Check Your Current CIBIL Score

The first step to improving your CIBIL score is to know where you stand. Fortunately, you can check your CIBIL score for free online. Websites like CIBIL’s official site and other third-party platforms offer free access to your score once a year. By knowing your current score, you can better understand how much effort is needed to boost it.

Step 2: Dispute Any Errors on Your Credit Report

Sometimes, mistakes in your credit report can affect your CIBIL score. These errors could include incorrect personal information, duplicate accounts, or outdated credit limits. If you find any discrepancies, it’s important to dispute them immediately. CIBIL allows you to report errors directly through their website, and they will investigate and resolve the issues within a few weeks.

Step 3: Clear Outstanding Dues

Unpaid dues, whether from credit cards or loans, can have a major impact on your CIBIL score. One of the first things you should do to improve your score is pay off any outstanding balances. If you have multiple dues, try to prioritize clearing high-interest debt first. For long-term improvement, aim to stay on top of your payments and avoid accumulating unpaid dues.

Step 4: Reduce Your Credit Utilization

Your credit utilization ratio is the percentage of available credit you’re using. For example, if you have a credit limit of ₹1,00,000 and you’re using ₹70,000, your utilization ratio is 70%, which is high. Ideally, your credit utilization should be under 30%. To reduce your credit utilization, focus on paying down your balances and consider requesting a higher credit limit if you’re unable to lower the amount spent.

Step 5: Maintain a Healthy Credit History

A healthy credit history is key to improving your CIBIL score. This means paying your bills on time, avoiding defaults, and making responsible credit decisions. The longer you maintain a positive credit history, the better your score will become. Regularly check your credit report for errors, and set reminders for bill payments to stay on track.

Step 6: Avoid Frequent Credit Applications

Every time you apply for a loan or a new credit card, an inquiry is made on your credit report. Multiple credit inquiries in a short period can damage your CIBIL score. Instead, apply for credit only when necessary. This will help prevent your score from taking unnecessary hits.

Step 7: Diversify Your Credit Portfolio

A diverse credit portfolio shows that you can handle different types of credit responsibly. For example, if you have only one type of credit—say, a credit card—consider adding other types of credit like a small personal loan or a car loan. However, do not take on more debt than you can manage, as this could backfire.

Useful Online Tools and Apps to Monitor Your Score

Several online tools and apps can help you track and monitor your CIBIL score. Some of the best options include:

- CIBIL’s Official Website: You can check your score and credit report directly from the source.

- Credit Karma: This free app gives you access to your credit score and provides personalized tips to improve it.

- BankBazaar: Offers free credit reports and CIBIL score checks along with suggestions on how to improve it.

Using these tools regularly will help you stay on top of your credit and make informed decisions.

Benefits of a Higher CIBIL Score

A higher CIBIL score comes with several advantages:

- Better Loan Approvals: A good score increases your chances of getting your loan approved faster.

- Lower Interest Rates: A higher score means you’re less of a risk to lenders, allowing you to secure loans at lower interest rates.

- Better Credit Card Offers: You’ll have access to credit cards with higher limits and better rewards.

- Negotiation Power: A good score gives you the power to negotiate better terms when applying for loans or credit cards.

Conclusion

Improving your CIBIL score takes time and discipline, but with the right approach, you can boost your score and unlock better financial opportunities. Follow the steps outlined in this guide, use online tools to track your progress, and remain consistent with your payments. With patience and persistence, you’ll see your CIBIL score rise and experience the benefits of having a stronger credit profile.

FAQs

1. How long does it take to improve my CIBIL score?

It typically takes a few months to see significant improvement in your score. The key is to be consistent with your payments, reduce debt, and monitor your score regularly.

2. Can I check my CIBIL score for free?

Yes, you can check your CIBIL score for free once a year on CIBIL’s official website or through third-party platforms.

3. What is the minimum CIBIL score needed for loan approval?

While different lenders have different requirements, a CIBIL score of 750 or above is generally considered ideal for loan approval.

4. Will paying off my credit card balance improve my CIBIL score?

Yes, paying off your credit card balance reduces your credit utilization ratio, which can positively affect your score.

5. Can a high CIBIL score guarantee loan approval?

While a high CIBIL score improves your chances, other factors such as income, employment stability, and existing debts also play a role in loan approval.