Your CIBIL score is like a report card for your financial health—it determines how easily you can get loans or credit cards. Want a higher score? Good news! You can improve it online and without spending a penny. Let’s dive into how you can CIBIL score enhance your CIBIL score in 2024, step by step.

Table of Contents

Understanding CIBIL Score

What is a CIBIL Score?

A CIBIL score is a three-digit numerical representation of your creditworthiness, ranging from 300 to 900. It is calculated by TransUnion CIBIL, one of India’s leading credit bureaus, based on your credit history, repayment behavior, and credit utilization.

Why is a Good CIBIL Score Important?

A good CIBIL score is your golden ticket to financial perks. With a high score, you can enjoy lower interest rates, faster loan approvals, and better credit card offers. Plus, some employers even check credit scores during the hiring process. It’s not just about borrowing; it’s about creating opportunities.

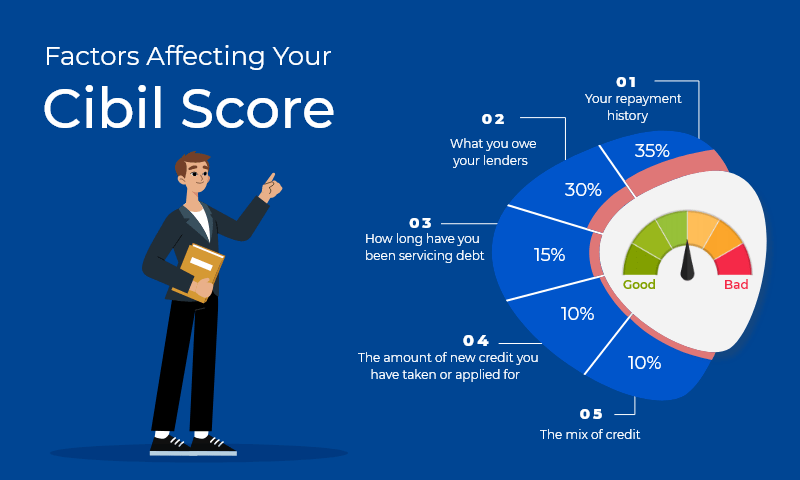

Factors Affecting Your CIBIL Score

Payment History

Paying your bills on time is crucial—it accounts for 35% of your score. Late payments are like missed deadlines in school; they affect your overall performance. Set reminders to ensure you’re never late.

Credit Utilization Ratio

Imagine spending most of your paycheck before the month ends—it’s stressful and risky. Similarly, using more than 30% of your credit limit can hurt your CIBIL score. Aim to keep your credit card balances low.

Length of Credit History

The longer your credit history, the better. It’s like building a relationship—lenders trust you more when they see a stable and long-term credit record. If you have old credit accounts, keeping them active can benefit your score.

Steps to Check Your CIBIL Score Online Free in 2024

Registering on the Official CIBIL Website

You can check your for free once a year through the official CIBIL website. Just sign up with your personal details, including your PAN card, and you’re good to go. It’s simple, secure, and efficient.

Using Third-Party Platforms

Trusted platforms like Paisabazaar and BankBazaar also offer free CIBIL score checks. These platforms allow you to access your score more frequently than the official website. Always ensure you’re using reputable sites to protect your data.

Avoiding Fraudulent Websites

Not all websites are safe. Avoid sharing personal information on unverified platforms. Always double-check the authenticity of a website before providing sensitive details.

Practical Ways to Improve Your CIBIL Score Online

Regularly Monitor Your Credit Report

Errors on your credit report can pull down your score. Regularly reviewing your report helps you spot inaccuracies, like a wrongly reported missed payment. If you find any errors, raise a dispute immediately.

Set Up Payment Reminders

Life gets busy, and it’s easy to forget due dates. Setting up reminders through apps or SMS alerts can help you pay your bills on time and boost your score.

Keep Credit Card Balances Low

Maxing out your credit cards sends a red flag to lenders. Keep your utilization below 30% of your total credit limit. For example, if your limit is ₹1,00,000, try not to exceed ₹30,000.

Avoid Frequent Loan Applications

Applying for multiple loans or credit cards in a short time can make you appear desperate, which can negatively impact your score. Be selective and strategic when applying for credit.

Pay Off Outstanding Dues

Clearing old debts can significantly improve your score. Focus on paying off high-interest loans first, as they’re the costliest to maintain.

Free Tools and Resources to Improve Your CIBIL Score

Financial Planning Apps

Apps like Money View, Walnut, and Cred can help you track expenses, set budgets, and manage repayments. These tools make it easier to stay on top of your finances and improve your credit score.

CIBIL Score Improvement Tools

Some banks and financial institutions offer tools specifically designed to help you boost your. These include credit score simulators and debt management programs. Leverage these free resources for faster results.

Common Mistakes to Avoid While Improving Your CIBIL Score

Ignoring Errors on Your Credit Report

Mistakes on your credit report can cost you. Regularly review your report and dispute any inaccuracies. Correcting errors can make a significant difference to your score.

Overusing Credit Cards

Spending close to your credit limit can harm your score. Maintain a healthy credit utilization ratio to show lenders you’re financially responsible.

Closing Old Credit Accounts

Closing old accounts might seem like a clean slate, but it can shorten your credit history and lower your score. Unless absolutely necessary, keep older accounts open to maintain a longer credit history.

How Long Does It Take to Improve Your CIBIL Score?

Patience is key when it comes to improving your. Minor improvements can take 3-6 months, while significant changes might take a year or two. Consistency in your financial habits is crucial for long-term success.

Conclusion

Improving your CIBIL score online and for free in 2024 is achievable with the right strategy. By understanding the factors that affect your score, avoiding common mistakes, and using free tools, you can pave the way to financial success. Remember, it’s a gradual process—stay consistent and committed, and you’ll see results.

FAQs on Improving CIBIL Score Online

1. How often can I check my CIBIL score for free?

You can check it once a year for free on the official CIBIL website. Some third-party platforms allow more frequent checks.

2. Can errors on my credit report lower my score?

Yes, even small inaccuracies can impact your score. Regularly review your report and dispute any errors you find.

3. Does using a credit card improve my CIBIL score?

Yes, responsible credit card use and timely payments can improve your score over time.

4. Will paying only the minimum due on credit cards improve my score?

No, paying just the minimum can lead to high-interest charges and negatively affect your score in the long run.

5. Can I improve my score if I have a history of missed payments?

Absolutely. Start by paying your bills on time and clearing outstanding debts. Gradual and consistent efforts will improve your score.