Curious about Chase credit cards? Learn everything about Chase credit card limits, rewards, how to apply, fees, and more in this comprehensive guide.

Table of Contents

Introduction

If you’ve ever thought about signing up for a Chase credit card, you’ve probably got a ton of questions: How do I apply? What’s the credit limit? What about rewards? And are there any hidden fees lurking around? You’re not alone! Chase is one of the biggest names in the credit card game, offering a variety of cards that promise to make your spending more rewarding. Whether you’re a travel enthusiast looking for miles or someone who wants to maximize cash back, Chase has something for you.

In this guide, we’ll dive into everything you need to know about Chase credit cards—credit limits, rewards, how to apply, fees, and more. So, if you’re ready to get the inside scoop on one of the most popular credit card issuers, let’s go!

Chase Credit Card Limits

When you first apply for a Chase credit card, one of the most pressing questions on your mind is probably, “How much can I borrow?” The credit limit you get on a Chase card can vary depending on several factors, including your credit score, income, and overall financial health.

What Influences Your Chase Credit Card Limit?

Here’s a quick rundown of what determines your limit:

- Credit Score: The higher your score, the better your chances of getting a higher limit. A good rule of thumb is to aim for a score of at least 700 to score a decent limit.

- Income: Your income plays a big role. The more you earn, the more credit Chase is willing to extend. You may even be able to request a higher limit based on your income.

- Credit History: If you’ve been responsible with credit in the past, you may qualify for a higher limit. The opposite is true if you’ve had issues like late payments or defaults in the past.

- Current Debts: Chase will also look at how much debt you have. If you’ve got a lot of outstanding balances, they might offer a lower limit to minimize risk.

How to Increase Your Chase Credit Card Limit

If you start off with a lower credit limit, don’t worry—you can usually request a limit increase after some time. Here’s how:

- Build a Good Payment History: Keep paying off your balances on time and in full. This will show Chase that you’re financially responsible.

- Increase Your Income: If your financial situation improves, consider reporting your higher income to Chase.

- Request a Limit Increase: After about 6 months, you might want to call Chase and request a credit limit increase.

Chase Credit Card Rewards

One of the major draws of Chase credit cards is the rewards! Whether you’re a cash-back lover or a frequent traveler, Chase has cards that offer some seriously good perks.

Types of Rewards Programs

Chase offers several types of rewards programs, so there’s something for everyone:

- Cash Back: If you’re the practical type who just wants to earn a percentage back on every purchase, Chase offers cards like the Chase Freedom Flex℠ and Chase Freedom Unlimited®. These cards let you earn cash back on everyday spending, from dining to grocery shopping.

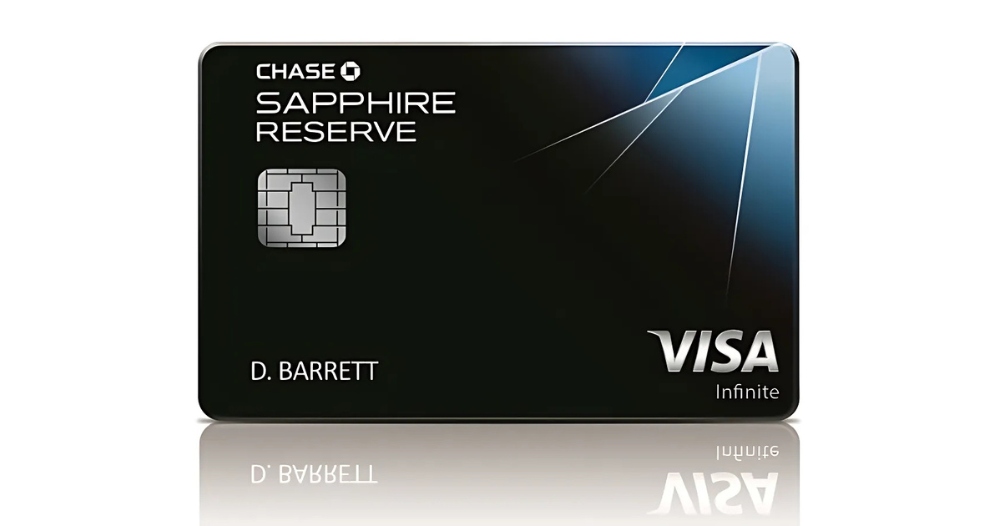

- Travel Miles: If you’d rather rack up points that you can redeem for travel, the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® could be your go-to. You can use your points for flights, hotel stays, and more through the Chase Ultimate Rewards® program.

- Points for Purchases: Some Chase cards allow you to earn points on general purchases, which can then be redeemed for merchandise, gift cards, or travel.

How Chase Credit Card Rewards Work

Each Chase credit card has a different rewards structure, but here’s a quick look at some of the most popular:

- Chase Freedom Unlimited®: Earn 1.5% cash back on every purchase, 5% on travel through Chase Ultimate Rewards, 3% on dining, and 3% on drugstore purchases.

- Chase Sapphire Preferred® Card: Earn 2x points on travel and dining, 5x points on travel through Chase Ultimate Rewards, and 1x point on everything else.

The Chase Ultimate Rewards® Program

Chase Ultimate Rewards® is where the magic happens! Points earned with certain Chase cards can be transferred to partners like airlines, hotels, and car rental agencies for potentially greater value. So, if you’re into travel hacking, this could be a huge advantage.

How to Apply for a Chase Credit Card: Step-by-Step

Applying for a Chase credit card is easy—but you’ll want to make sure you’re well-prepared before you fill out that application. Here’s a step-by-step breakdown of the process.

1. Choose the Right Card for You

Not all Chase cards are created equal. If you’re into cash back, go for a card like the Chase Freedom Unlimited®. If you’re planning to travel, the Chase Sapphire Preferred® might be more your style.

2. Check Your Credit Score

Before applying, it’s a good idea to check your credit score. This will give you an idea of which cards you’ll be eligible for. Most Chase cards require a good to excellent credit score (typically 700 or higher).

3. Gather Your Information

You’ll need to provide some personal details, including:

- Your full name

- Address

- Social Security number

- Employment information

- Income details

4. Fill Out the Application

You can apply online or over the phone. The online process is quick and straightforward, and you’ll usually get a decision within a few minutes.

5. Wait for Approval

Once you’ve submitted your application, you’ll either get an immediate approval, a denial, or be asked for additional information. If you’re approved, you’ll receive your card in the mail in about 7–10 business days.

Chase Credit Card Fees

Like any credit card, Chase credit cards come with their own set of fees. You’ll want to be aware of these to avoid unpleasant surprises down the line.

Common Chase Credit Card Fees

- Annual Fee: Some cards (like the Chase Sapphire Reserve®) charge an annual fee. However, this is often offset by the value of rewards and benefits.

- Foreign Transaction Fees: Many Chase cards don’t charge foreign transaction fees, but you’ll want to double-check if you’re planning on using your card abroad.

- Late Payment Fee: If you’re late making a payment, expect to be hit with a fee, typically around $40.

- Cash Advance Fee: If you need cash, Chase will charge a fee for advances, plus interest, which usually starts accruing immediately.

- Returned Payment Fee: If your payment bounces, you’ll be charged a fee.

Conclusion

Whether you’re looking to earn some serious rewards, build credit, or enjoy the benefits of a low-interest rate, Chase credit cards have plenty to offer. Understanding your credit limit, the rewards you can earn, how to apply, and the fees involved can help you choose the best card for your financial goals. Just remember to keep an eye on your spending, pay your bills on time, and enjoy the perks!

So, what are you waiting for? If you’re ready to maximize your spending power, go ahead and apply for a Chase credit card today!

FAQs About Chase Credit Cards

What’s the Best Chase Credit Card for Beginners?

If you’re new to credit, the Chase Freedom Unlimited® is a great starter card. It has no annual fee and offers 1.5% cash back on every purchase.

Can I Apply for Multiple Chase Credit Cards?

Yes, you can apply for more than one Chase card. However, it’s important to note that Chase has a “5/24” rule, meaning you can only be approved for a new card if you’ve opened fewer than 5 credit accounts in the last 24 months.

How Long Does it Take to Get Approved for a Chase Credit Card?

Approval times vary. In most cases, you’ll know right away whether you’ve been approved or not. If more information is needed, you may have to wait a few days.

Do I Need Good Credit to Get a Chase Credit Card?

Yes, most Chase cards require good to excellent credit. But don’t worry—if your credit is fair, you might still qualify for some of their cards.

By: Cibilfree.com

Pingback: Bank of America Credit Card Limits, Rewards and Fees